Francesca Odella and Cinzia Lorandini

Time and Place: Thursday, 01.07., 10:00–10:20, Room 2

Session: Economic Transactions

In the last decades, a burgeoning literature has investigated the functioning of early modern credit markets. Scholars have provided new evidence on the embeddedness of credit relations within the broader social, cultural and institutional milieu, showing that lenders are not profit-maximising rational actors who merely pursue an economic interest (Muldrew 1998; Haggerty 2012; Fontaine 2014). Another strand of research has highlighted the peculiar function of notaries in contributing to the expansion of credit markets by matching demand and supply of credit (Hoffman et al. 2000; Clemens and Reupke 2009). Against this backdrop, we use historical network analysis to investigate both aspects and get new insights into the social dimension of credit in the early modern period. We analyze a dataset drawn from the private archives of a family business – the Salvadori firm of Trento – that achieved considerable economic and social advancement in the Prince-Bishopric of Trento in the eighteenth century (Lorandini 2015). Similarly to many other merchants active in long-distance trade, the Salvadoris took advantage of their excess liquidity to engage in lending activities, thus meeting the financial needs of different types of borrowers, among them merchants, artisans, professionals, clergymen, and patricians.

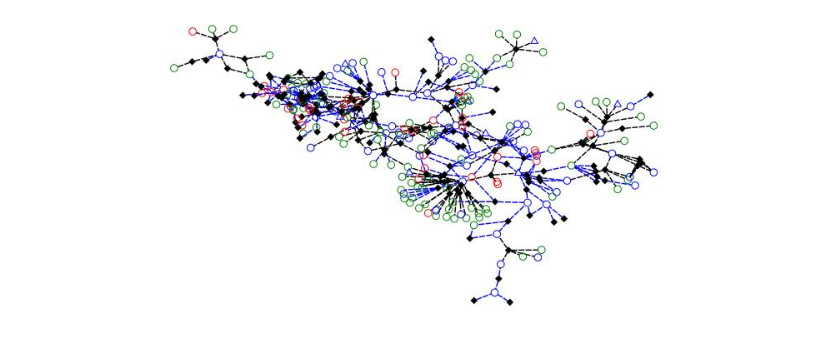

In an attempt to test some hypotheses concerning the social dimension of credit and the role of notaries we apply Social Network Analysis not merely to visualize the Salvadoris’ credit network, but rather to formalize their social and economic logic of action/business strategy (Erickson 1997; Brandes at al. 2012; Morrisey 2015). Specifically, we collect and merge cross-information from several business ledgers, to re-construct the credit history of the family from the 1740s through the 1760s, which allow us establishing the type of relationship between the lenders, the borrowers and other subjects involved (guarantors, commercial agents and notaries). The analysis was carried one along two viewpoints: at first, we explore the characteristics of the whole network (152 financial operation involving 208 different subjects and 329 edges) in relation to the type of subjects (borrowers, guarantor, others involved in the financial transaction). Our focus was on the borrowers’ social proximity – in terms of kinship, social class and business relationships – to the lender (the Salvadori firm), and we investigate whether this aspect influenced the features of credit transactions (e.g. interest rate, size and length of loans, type of credit instrument used).

The second purpose of the study was to investigate the role of notaries as financial intermediaries by analysing their position within the family’s credit network. A comparative analysis was performed on two sub-networks (one for standard lending contracts and one for those mediated by the notaries) to explore the structure of each subnetwork and its compositional elements (dyadic/triadic sets). The investigation confirms that credit networks created by notarized and non-notarized loans are different in terms of composition (type of subjects) and network structure (dyadic/triadic relations and chains). The results support the contention that notaries’ connections played a bridging role when social distance between actors was larger, facilitating access to and circulation of credit. This conclusion holds however mostly for credit relations between the merchant family and borrowers of lower social status, and less for credit relationships with the upper echelons of the local milieu, such as aristocrats and patricians. While in the first cases, the recourse to notaries responded to the need to enhance enforceability of the contract, in the latter cases political motivations for granting the loans might prevail over the interest of obtaining strong guarantees for capital refunding. The analysis of the evolution of the credit network in the observed period confirms thus the hypothesis about the bridging role of notaries in paving the way for the access of new classes to rising credit markets, and assesses the embeddedness of lending relations in the social and political context of an early modern urban economy.

Brandes, U., J. Pfeffer, and I. Mergel 2012. Studying social networks: A guide to empirical research, Frankfurt: CampusVerlag.

Clemens, G.B., and D. Reupke 2009. ‘Der Notar als Broker: Das Management des privaten Kreditmarktes’, Zeitschrift für Verbraucher- und Privat-Insolvenzrecht 8, no. 12, pp. 16–22. Erickson, B. 1997. ‘Social Networks and History: a review essay’, Historical Methods 30, no. 3, pp. 149-157.

Fontaine, L. 2014. The Moral Economy. Poverty, Credit, and Trust in Early Modern Europe, Cambridge: Cambridge University Press.

Hoffman, P.T., G. Postel-Vinay, and J-L. Rosenthal 2000. Priceless Markets. The Political Economy of Credit in Paris, 1660-1870, Chicago: University of Chicago Press. Lorandini, C. 2015. ‘Looking beyond the Buddenbrooks syndrome: The Salvadori Firm of Trento, 1660s-1880s’, Business History, 57 (2015), no. 7, pp. 1005-1019.

Morrissey, R.M. 2015. ‘Archives of Connections’, Historical Methods 48, no. 3, pp. 67-79. Muldrew, C. 1998. The Economy of Obligation. The Culture of Credit and Social Relations in Early Modern England, Basingstoke-London: Macmillan.